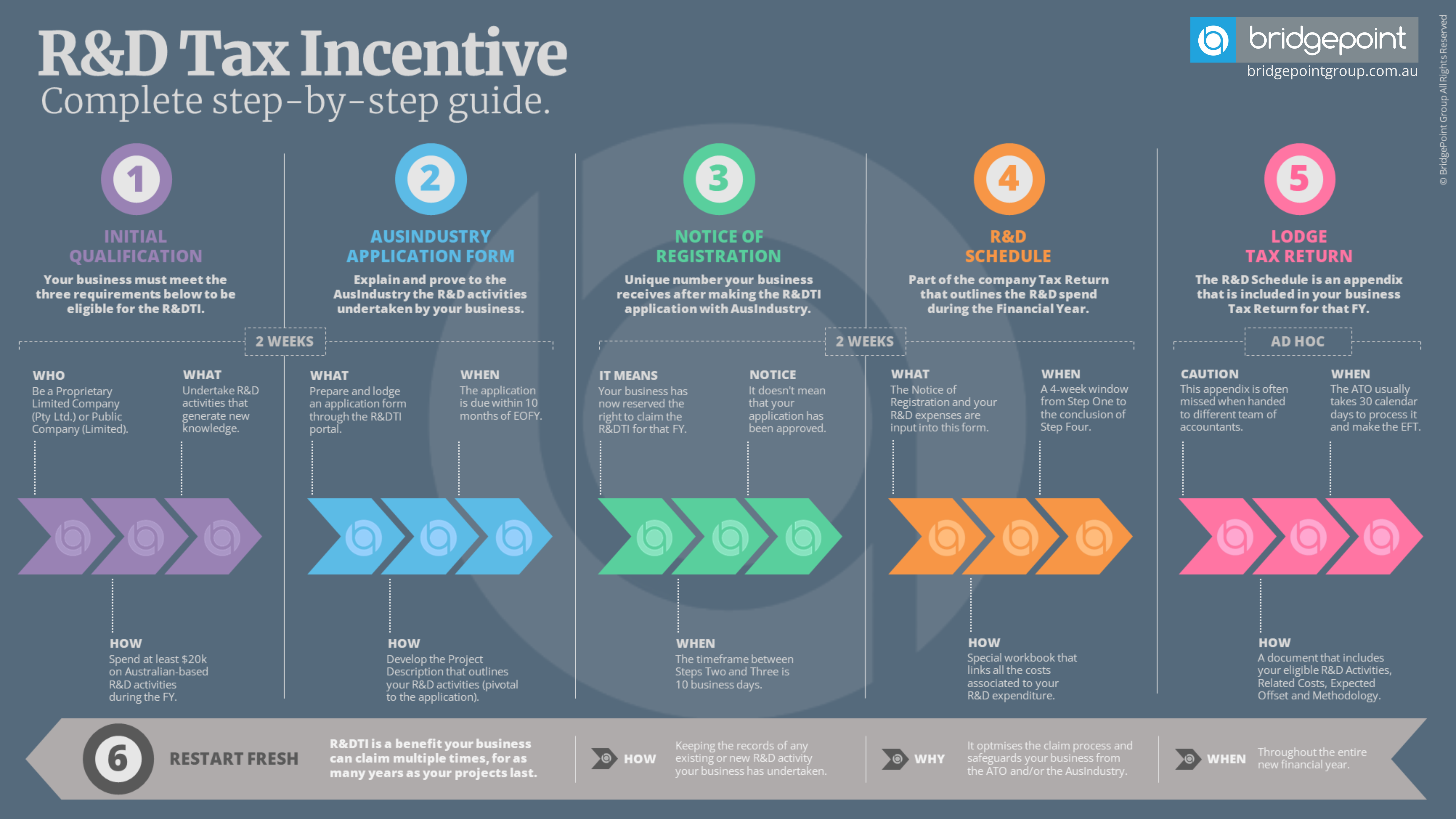

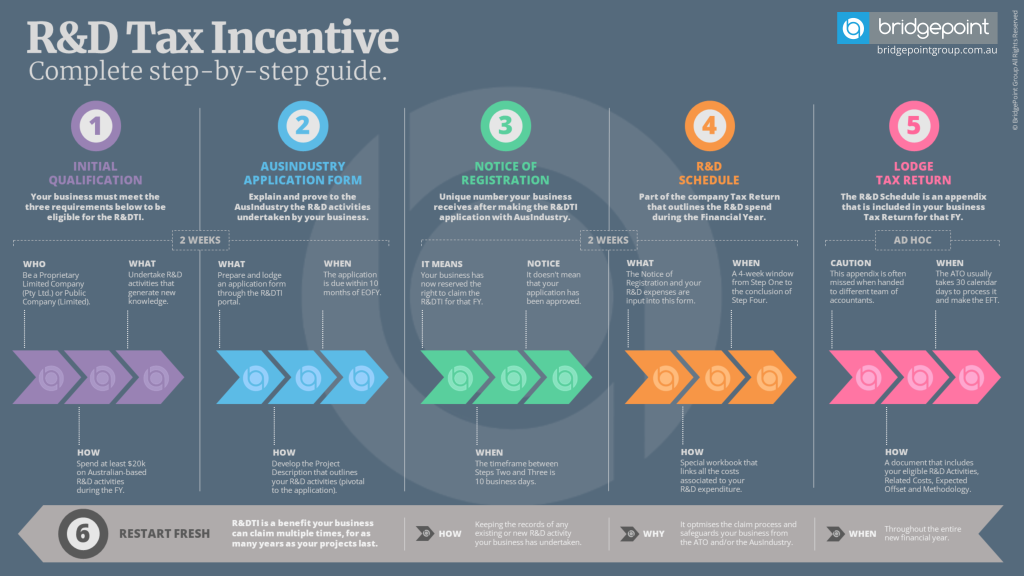

A clear and straightforward step-by-step guide for companies seeking information on how to claim the R&D Tax Incentive. In this article, you will learn about:

- R&D activity qualification requirements.

- How to apply for the R&D Tax Incentive.

- Required documentation for your R&D activities.

- How to include R&D spending in the Tax Return.

Step one:

R&D Tax Incentive Qualification

R&D Tax Incentive Qualification

Step One involves a qualifying check-up to determine three key aspects of your business’ eligibility:

- Does your business have the correct entity structure? In short, only companies can claim R&DTI. This means that Trusts, Sole Traders, or Partnerships normally cannot.

- Does your business undertake activities that fall within the scope of what is considered R&D? R&D involves the generation of new knowledge through the design and development of a new or improved product, process or service which takes place in Australia.

- Does your business meet the minimum expenditure requirement? You must have spent at least $20,000 on Australian-based R&D to qualify.

R&D Tax Incentive claim process can be a self-assessment. However, the process of claiming the R&D Tax Incentive is complex. It is recommended to hire an R&D Tax Incentive specialist who can ensure that you accurately define your R&D activities and claim all the relevant costs. Here is an example.

Case study – Missing Qualified Claims:

A client of ours used to claim R&DTI by themselves but due to the complexity of the process and lack of expertise in their team, they ended up engaging our services. When we assessed their cost inputs, we noticed some missing amounts over the last three years, the main one being their indirect costs. They had no understanding of what indirect costs were, nor did they include them as part of their R&D expenditure. Together, we revised their prior two years’ worth of tax returns to include these indirect costs.

The deadline for submitting an R&D Tax Incentive application is ten months after the End of Financial Year (EOFY).

Therefore, if your business’ Financial Year ends on the 31st of December, you have until the 31st of October to submit your application. If your business’s Financial Year ends on the 30th of June, you have until the 30th of April. It’s a strict deadline. Extensions are not granted. Missing the deadline means missing the opportunity to receive a 43.5% tax cash refund for every dollar spent on R&D activities for that particular financial year.

Once you determine that your business qualifies for the R&D Tax Incentive, you can proceed to Step 2.

If you’re still not sure, we answer some of the most common questions about R&D Tax Incentive here.

Step Two:

AusIndustry R&D Application Form

AusIndustry R&D Application Form

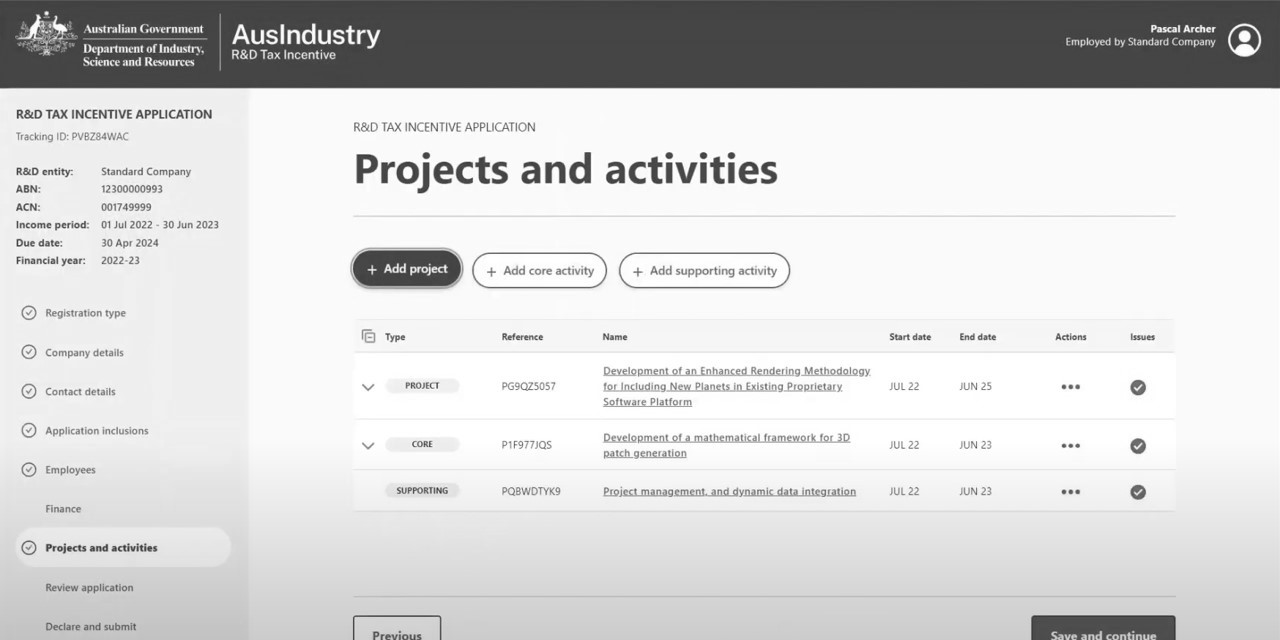

Once you’ve determined that you can make a claim, you will prepare and lodge an R&D Application Form with AusIndustry. This is the stage where you must elucidate and substantiate your R&D activities to AusIndustry, facilitated through their portal.

This 30-min video from AusIndustry illustrates in detail the process in their portal.

Despite the illustrative video, this is exactly where the R&D Tax Incentive process starts to become intricate, and some companies encounter difficulty accessing the application form.

This electronic process via the R&DTI online portal often leads to confusion. With a plethora of options in the application form, it is easy to inadvertently select the incorrect one, setting off a chain reaction of errors.

R&D Tax Incentive Example – Making the Wrong Application:

Within the AusIndustry Application Form, you will encounter convoluted questions such as “Are you part of a Tax Consolidated or Multiple Entry Consolidated group?” Many applicants are unfamiliar with such terms and resort to searching for clarification online, yet it remains perplexing. Some may assume their business is part of a group due to subsidiary entities, although this does not necessarily entail tax consolidation. Another example is the question “Are you conducting this activity for the purpose of generating new knowledge?” Selecting YES prompts a new text box to explain the new knowledge being generated. However, some companies are uncertain and select NO, bypassing crucial questions.

Misunderstanding technicalities or specific terminologies on the application form can lead businesses to select the wrong options, potentially jeopardising their application’s success. This is where the R&D Tax Incentive specialist plays a critical role.

Advantages of Hiring an R&D Tax Incentive Professional

The process of claiming the R&D Tax Incentive is time-consuming, and at times, confusing for those who are not familiar with the process. An experienced R&D Tax Incentive specialist like BridgePoint Group can facilitate the preparation and lodgement of your claim, liaising with both AusIndustry and the ATO. The benefits of hiring an R&D Tax Incentive expert encompass the following:

- Helping assess your eligibility and determining the feasibility of proceeding.

- Conducting a comprehensive financial analysis to capture all relevant activities and expenses.

- Maximising the chances of a successful claim.

- Legitimately maximising your claim.

- Reducing timing, costs and resources of making the application.

Learn more about BridgePoint Group’s R&D Tax Incentive service.

One of the key benefits of hiring BridgePoint Group for your R&D Tax Incentive claim is that between Step One and Step Two, we prepare what we refer to as the Project Description. This document effectively outlines the activities and is pivotal to the application process, because keep in mind, you can only claim R&D expenditure for activities that are presented to AusIndustry. We draft the project description, present it to the client for review and approval. It is based on the qualifying check-up and supporting documentation provided by the client.

Project Description Breakdown:

The Project Description comprises nine parts, each requiring detailed explanations (between 1,000 and 4,000 characters) for the following:

- Project Objective: What are you aiming to design and develop?

- Hypothesis: What is your testable statement?

- New Knowledge: What is the new knowledge that you are generating as a result of conducting this R&D project?

- Technical Uncertainty: What technical uncertainties prevented you from knowing the outcome in advance?

- Experiments: What experiments did you conduct to test the hypothesis?

- Evaluations: What evaluations have you made?

- Conclusions: Any conclusions for this income period should be clearly stated.

- Supporting Activity: What supporting activities have been undertaken?

- Linking Supporting Activity to Core Activity: Why was it necessary?

From the qualifying conversation to the lodgement of the Application Form, including the Project Description, a timeframe of one to two weeks of work should be expected. Step Two concludes with an email confirmation from AusIndustry upon application lodgement. However, the key to a successful application lies in Step Three, obtaining the Notice of Registration.

Step Three:

Notice of Registration

Notice of registration

The Notice of Registration is a unique number your business receives after making the R&D Tax Incentive application with AusIndustry. It looks like this: IR2400001, where the IR number is based on the financial year (24 if it’s FY24), followed by a sequence of numbers that represent the order you’ve lodged in the queue for that year. If you’re the first to apply in that year, then your number will be 00001.

The Notice of Registration means that your business activities have been registered with AusIndustry. It doesn’t mean that your application has been approved. But it’s an important outcome, given this number means your business has now reserved the right to claim the R&D Tax Incentive for that Financial Year. Some companies are not able to reach this step due to errors on the application form that disqualify them.

The timeframe between Step Two and Step Three is usually 10 business days. The extensive and solid experience of Bridgepoint Group in claiming R&D Tax Incentive has given us the ability to manage Steps Two, Three, and Four almost simultaneously, providing our clients with a faster turnaround time from the qualification step to lodging the Tax Return. It only depends on our clients’ capabilities to provide us with the information we need.

Let’s then dive deep into Step Four.

Step Four:

R&D Schedule

R&D Schedule

In Step Four, the Notice of Registration number is input into your R&D Schedule – an online form to report your business R&D activities to the ATO. The R&D Schedule includes all the costs associated with the R&D activities.

It is in Step Four where BridgePoint Group plays another critical role for the success of your R&D Tax Incentive application. In this step, we develop what we call the Costing – a similar type of work to the Project Description that we do between Steps One and Two.

Learn more about BridgePoint Group’s R&D Tax Incentive service.

Costing

The Costing is a special workbook that links all the costs associated to your R&D expenditure. Some of the costs can include:

- Salaries & Wages (including on costs)

- Contractor costs

- Direct costs

- Overheads

- Depreciation

- Feedstock

In this process, we also calculate the relevant offset, which is the benefit your business will receive from all the eligible costs associated with your R&D expenses. The Costing Workbook effectively goes into the R&D Schedule with the ATO as a separate appendix.

You can expect a four-week window of work from the beginning of Step One (Qualification) to the conclusion of Step Four (submission of the R&D Schedule within the ATO). Usually, this is where most of the companies that provide R&D Tax Incentive services finish their work.

However, by deliberately deciding not to continue to work further, they leave their clients alone in what we consider one of the most important aspects of a successful R&DTI application – lodging the Tax Return

Step Five:

Tax Return Lodgement

Tax Return Lodgement

The R&D Schedule is an appendix to your business Tax Return. Normally, it’s the final piece of the puzzle before your lodgement. That’s why having one team overseeing the entire process is critical. It’s a very common mistake to overlook the R&D Schedule appendix when it is handed over to a different accounting team, which is only responsible for the Tax Return.

This Appendix is your company’s only chance to show the ATO how much eligible R&D expenditure your business had, so the cash refund can be processed, and you can receive an Electronic Funds Transfer (EFT). Still, when a client prefers to lodge the Tax Return through their own accounting team, then we provide the Claim Letter.

R&D Claim Letter

The Claim Letter is a summary where we provide to our clients with details:

- Eligible R&D activities for the period

- Related Costs

- Expected Offset/Benefit

- Methodology

It’s important to note that our R&D Tax Incentive claim process takes four weeks to determine how much your business is eligible to receive. It’s not the timeframe for when your business will receive the benefit.

The timeframe for the cash refund landing in your bank account depends on when you lodge your Tax Return and, ultimately, how long the ATO takes to process it (usually 30 calendar days – as a general standard). Therefore, the sooner you complete the R&D Schedule, the sooner you can lodge the Tax Return.

Interestingly, the R&D Tax Incentive claim process doesn’t end when you lodge the Tax Return. Once you lodge, you should always come back and start fresh for the new Financial Year.

This is because the R&DTI is a benefit your business can claim multiple times, for as many years as your projects last. That is why we include a sixth step in this R&DTI process: Ongoing Documentation.

Step Six:

Ongoing R&D Documentation

Ongoing R&D Documentation

Implementing an Ongoing Documentation plan is crucial for efficient and successful R&D Tax Incentive applications. Throughout the Financial Year, we track your business activities and ensure they meet R&DTI qualifications, updating project descriptions quarterly.

This streamlines the next application cycle, reducing it from 4 weeks to 2, as all activities and costs are pre-qualified. This means your business can submit a new R&D Tax Incentive application on Day 1 of the new Financial Year. By year-end, you’ll know your exact benefit, receiving cash refunds promptly.

Beyond efficiency, our Ongoing Documentation serves as a defence mechanism, protecting your business from stand up to scrutiny from regulatory authorities like AusIndustry and the ATO. Quarterly reports based on this documentation expedite any inquiries, ensuring smooth processes.

If you would like to engage an R&D Tax Incentive specialist to determine whether or not your company qualifies for the R&D Tax Incentive then please reach out to Alan Baghdasarayan, Government Grants & Incentives Director at BridgePoint Group who will provide a free 30-minute consultation.