This is Part 6 of the step-by-step guide for companies seeking information on how to claim the R&D Tax Incentive. You can read the full guide about How to Apply R&D Tax Incentive here. In this article, you will learn about:

- What is the BridgePoint Group R&D Ongoing Documentation

- The benefits of having ongoing R&D expenditure reports

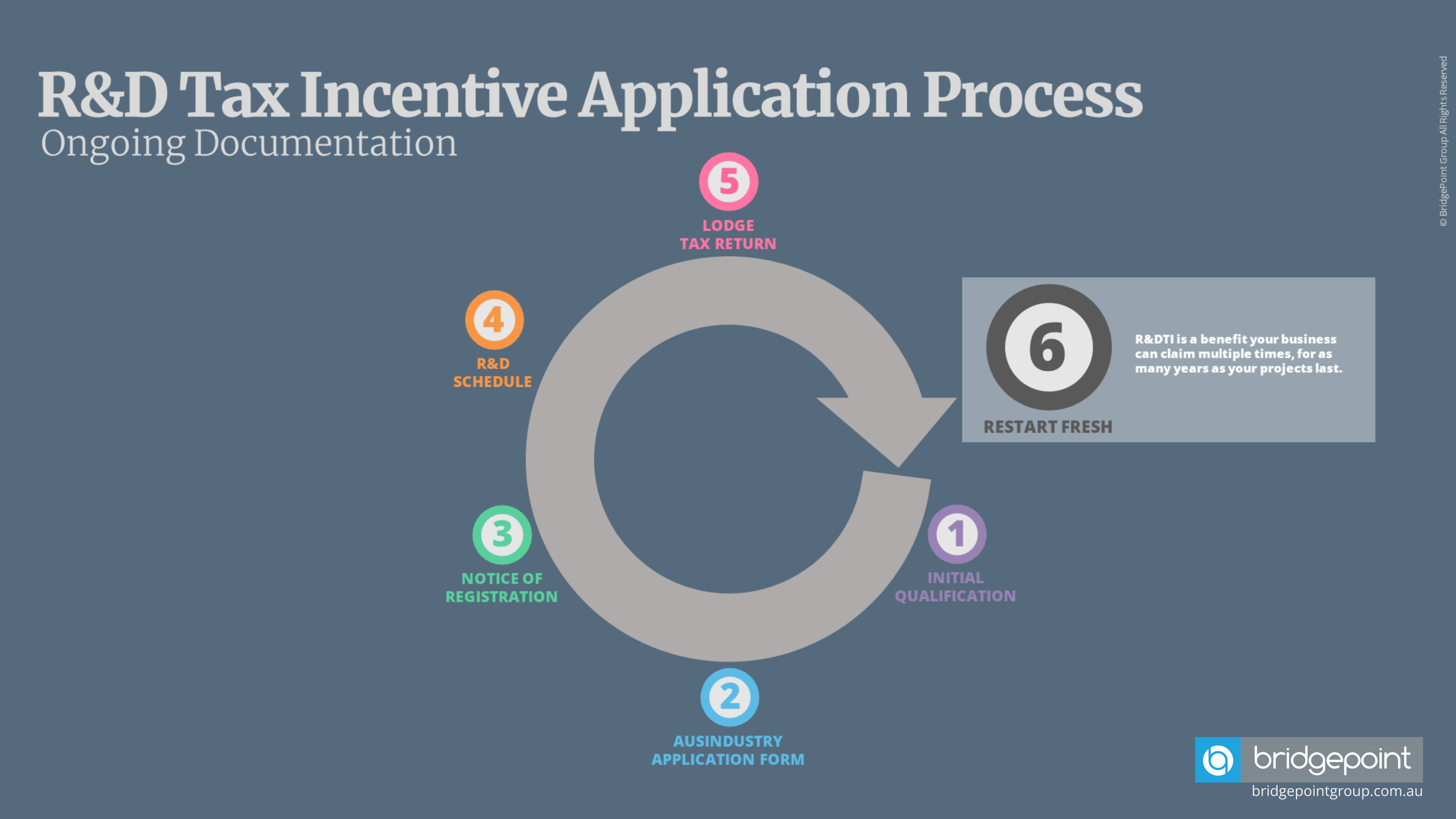

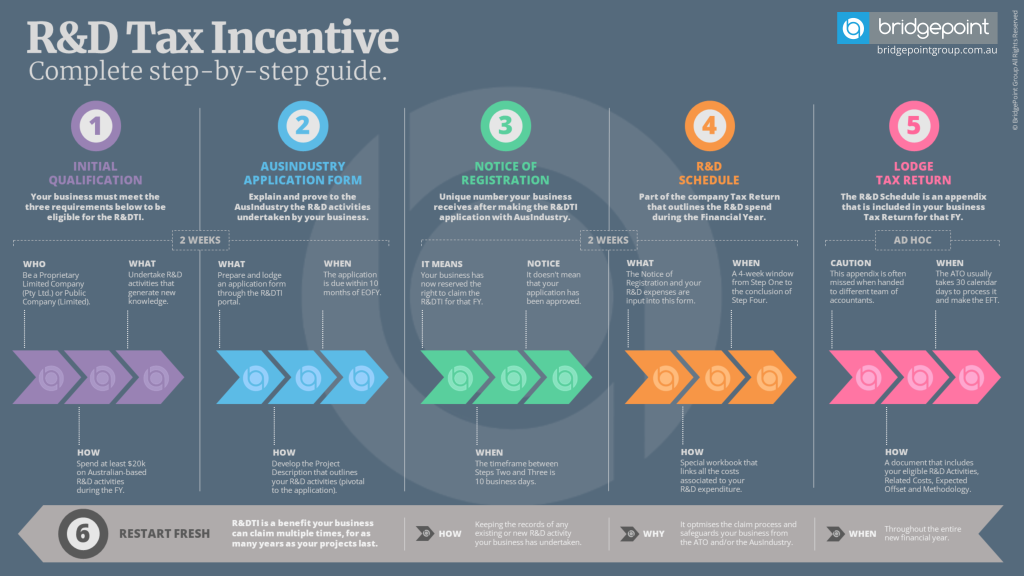

R&D Tax Incentive – Ongoing Documentation

Having an ongoing documentation plan is the ultimate process any business could implement for accurate, fast, stress-free, and successful R&DTI applications.

Throughout the Financial Year, we document any new activity your business has undertaken, how they can qualify for the R&DTI, etc. We then prepare your company’s quarterly R&D reports.

With the Ongoing Documentation, the next cycle to claim the R&DTI won’t take your business 4-6 weeks anymore. Instead, it will be shortened to two weeks, as your activities and costs have been already updated throughout the whole year and they are qualified and ready to be claimed.

It means that on the day 1 of the new financial year, your business will be ready to lodge a new R&DTI Application Form within the AusIndustry, as we kept track of your R&D eligible activities all year round.

Learn more about BridgePoint Group’s R&D Tax Incentive service.

By the time the Financial Year come to an end, you will know the exact benefit your business will be granted and get your cash refund sooner than the previous year, with no surprises. However, the advantages of the Ongoing Documentation created by BridgePoint Group goes beyond the accuracy, fast pace, and likelihood of success.

A safeguard to your R&D Tax Incentive Applications

The Ongoing Documentation also works as your business’ defence mechanism. It safeguards your business from the AusIndustry and the ATO as either one (or both) of these regulatory authorities can clear you on your activities and/or your costs.

For example, before releasing an EFT, the ATO might ask how you calculated your R&D spend. You can confidently answer them by providing your costing workbook, demonstrating it is based on a quarterly documentation of your R&D (who spent what time on what, which contractors did you employ, what are your direct costs, etc.).

The quarterly reports help you expedite any matter with the AusIndustry and/or ATO in a matter of minutes.

If you still have questions, we answer some of the most common enquires about R&D Tax Incentive here.

If you would like to learn more about the benefits of the R&DTI Ongoing Documentation, then please reach out to Alan Baghdasarayan, Government Grants & Incentives Director at BridgePoint Group who will provide a free 30-minute consultation.