When businesses grow, they can quickly outgrow their corporate structure. And that’s a problem because it introduces a range of risks and constraints that threaten your growth and in the worst cases, your very survival. Happily, it’s a problem that can be solved. In this case study, we show you how we can help you to shrug off that ill-fitting suit.

Data

Sector: Manufacturing

Turnover: $50MM-$100MM

Net Assets: $20MM+

Staff: 200-500

Background

Like so many other Australian manufacturers, this business started in the backyard at home with no surety of success. It was the 1980s and the long lunch was in vogue, so the quality products were complemented by great customer relationships! The business today is far more complex and far more sophisticated than that. Customers now include multi-nationals and the major supermarket chains. Vertical integration means that in many instances, the business now produces its own packaging as well.

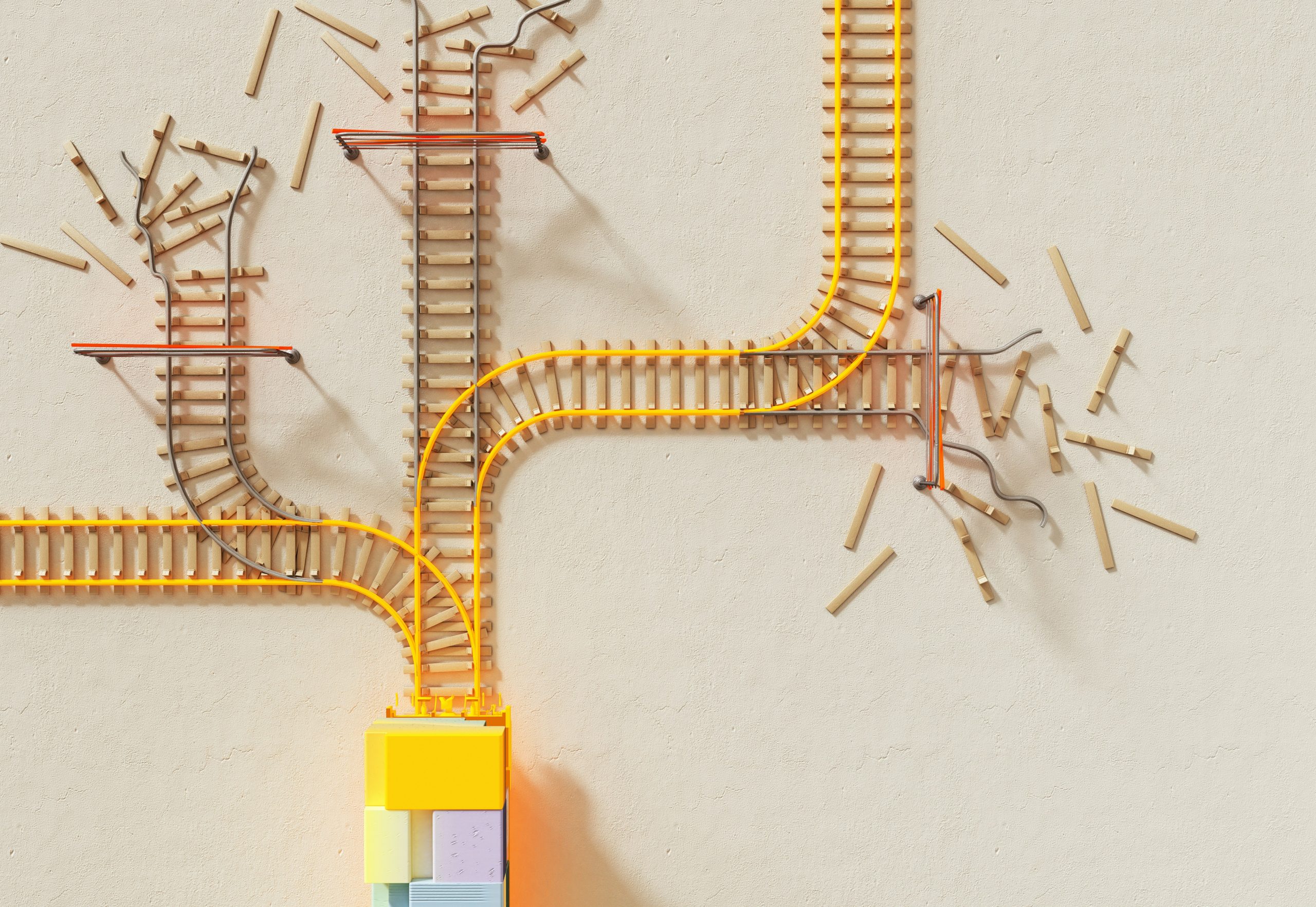

The Pre-existing Corporate Structure

What do you do when you first start out, not knowing how far you will get? You opt for low-cost, simple structures that are at least functional. And then you get on with growing the business! And that’s what happened here. Other than the factory site, which was segregated from the business, all trading and employment was carried out using a single private company that also owned the plant and equipment. The company was owned by a family trust.

The Issue

The company has built up substantial equity in the same entity that takes all the risk!

The Solution

The solution is incredibly simple in concept. Interpose a holding company between the trading entity and the family trust. This gives us three massive advantages.

First, we can pay dividends to the holding company without triggering an immediate tax consequence for the family. That money is now protected from creditors. It can be loaned back to the trading company if needed for cashflow and that loan can be secured.

Second, we now have the flexibility to add ‘sibling’ companies that own the assets and employ the staff. That protects the infrastructure of the business, so if the proverbial bus comes around the corner, the infrastructure the business uses to do what it does is tucked away out of harm’s way. The business lives to fight another day. Third, we can separate discrete business units from one another (e.g. separate packaging from core business). That means we can clearly see how that unit is performing and if we ever want to divest, that task just got easier.

Caution

This solution is easy to understand but needs to be implemented correctly to secure the advantages sought, without triggering unintended tax and other consequences.

Disclaimer

The content is merely for informational purposes. Everyone’s situation is different. We strongly advise you seek professional advice before acting on any of this information. If you act upon any information in this content without professional advice, you do so at your own risk.